What Common Sales Tax Mistakes Put Businesses at Risk of Audits and Penalties?

Sales tax audit is not a random one. More often than not, they are activated by patterns, irregularities, or typical compliance errors that are indicative of increased danger. Knowledge of the most frequent errors that businesses make is paramount in minimizing audit exposure and evading a penalty. The following are the major questions that bring out the fact that routine errors can be more chances of scrutiny.

How Does Failing to Register in the Right Jurisdictions Trigger Audits?

One of the worst errors is to make sales operations in a state or town without being duly registered with sales tax. The laws of economic nexus, marketplace, and remote sale thresholds tend to impose liabilities that businesses are unaware of. Unregistered activity is one significant red flag to the tax card and often results in an audit with a prolonged lookback.

Why Does Incorrect Product or Service Taxability Raise Red Flags?

There is a possibility of under-collection or over-collection made because of misclassifying taxable and exempt products or services. The auditors also scrutinize sectors with complex taxability regulations, including digital items, Software as a service, or offers.

The occurrence of multiple instances of error in taxability indicates low internal control levels and a high level of audit risk. Experienced IRS tax experts (former IRS tax agents, former CDTFA tax auditors, and experienced tax attorneys) can help to detect the red flags and help to maintain the taxability.

See also: How RTA Kitchen Cabinets Near Me Are Quietly Reshaping Luxury Home Renovations

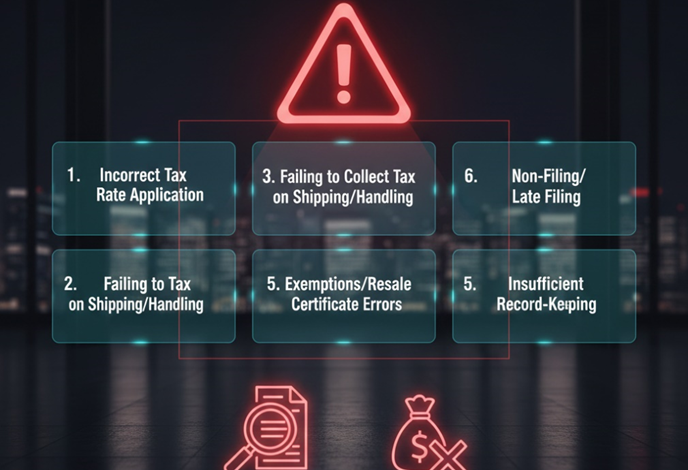

How Can Inaccurate Sales Tax Rates Lead to Penalties?

The use of wrong state, county, or city rates, particularly in jurisdictions that are destination-based, may lead to quick discrepancies. The auditors will tend to verify the reported sales against projected tax revenues. It is not difficult to detect variances based on rate errors, which tend to provoke further investigations.

Why Is Poor Management of Exemption Certificates a Major Audit Issue?

Among the most common findings of the audits are missing, expired, or incomplete exemption certificates. Exempt sales are considered to be taxable without correct documentations although the intended customer was really exempt. This oversight of documentation usually results in surprise evaluations and punishments.

How Does Failing to Reconcile Sales and Tax Reports Increase Scrutiny?

When taxable sales reported are at variance with financial statements, point-of-sale information, or income tax returns, auditors become alert. The absence of regular reconciliation implies a form of laxity and contributes towards a complete scope audit as opposed to a narrow review. The experts can help with the sales tax audit help, which will allow the business to maintain its records of the business.

Can Late or Inconsistent Filings Trigger an Audit?

Yes. Late filings, late payments, or high amendments are an indication of a challenge in compliance. The behavior of filing often puts businesses on audit watch lists, and this is usually done by tracking the behavior of the business by the tax authorities, even where the dollar significance is relatively small.

Why Are Marketplace and Online Sales Common Audit Triggers?

The biggest number of businesses make wrong assumptions that marketplaces take care of all the tax duties. The truth is that the responsibilities differ in accordance with the states and the type of transactions. Reporting mistakes tend to catch the eye of auditors, caused by misreporting the marketplace sales or not separating them from direct sales.

Can Poor Recordkeeping Alone Lead to Penalties?

Yes. Even where the tax is duly collected and paid, poor records may lead to estimate payments on audit. Lack of full documentation restricts the capacity of any business defending its stance, and the regulatory fines are greater.

The majority of tax sales audit instances are based on avoidable errors, as opposed to deliberate nonobservation. Lack of registration, taxability mistakes, missing records, and poor internal controls are all indications of risk to tax authorities.